(i)

Spouse is existing client

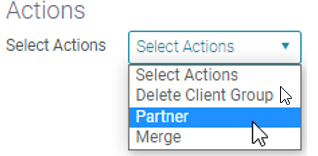

Select the

client then navigate to the Main Menu > Client > Client Actions >

Client Actions.

Under the

heading Actions, Select ‘Partner’ in the drop-down menu.

Search and

select the partner in the search field below, then select Submit.

This will

join two single individuals into the one client group.

Note: Only

clients assigned to the same adviser can be selected. If the partner has a

different adviser, you must assign it to the primary client’s adviser first

before this action can be completed.

All client

data from the spouse will be joined to the client group of the primary

individual.

The empty

client group of the spouse will be deleted after being transferred.

WARNING: Please

note that this will reset the modelling for each client as it is now based on a

couple. Please save any modelling information prior to completing any client

actions.

(i)

Spouse is not an existing client

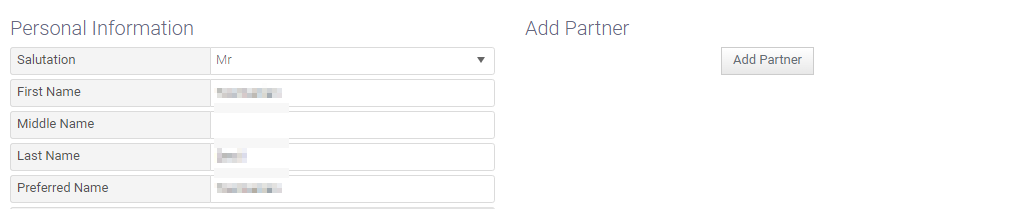

If a spouse hasn’t been entered in the system

yet, select the client then navigate to Client > Fact Find > Personal

details.

An "Add Partner" button will be available on this page, to the right side of your client's personal information

Enter

details of the spouse then click Ok. The spouse will now be added as a client

in AdviceOS.

This can be

achieved using the client admin button located via Client > Fact Find

> personal details. Here you can set either the client or partner has

deceased.

To set

Super Guarantee contributions in line with the legislated minimum, navigate to

the Main Menu > Client > Fact Find > Personal details. Scroll down to

the ‘Financial planning’ section and ensure the Legislated minimum box is

ticked. The Super Guarantee (%) field will be automatically calculated and can

no longer be edited.

A risk

profile questionnaire can be completed from the Client > Fact Find >

Personal details section of AOS. You can click on the Risk profile

button which will then create a new pop-up with the questions to answer for

your client.

Once the

risk profile questionnaire has been completed and saved, you can select the +

Create report button within the Risk Profile window to generate a report

with your client’s answers.

A risk profile described as ‘Not Matched’

indicates that the client’s set risk profile does not align with the answers to

their risk profile questionnaire. This could be due to a few reasons including

the questionnaire not being completed, a User changing the selected risk

profile drop down, or changes to the questionnaire or RP.

To correct this issue, you can either confirm

the client’s risk profile and match using the dropdown menu, or complete the

questionnaire correctly to reflect the appropriate RP.

Your client’s risk profile will originally be

set based on the answers to your RPQ or the dropdown RP chosen.

However,

the ‘View’ button allows you to see additional information of your client’s RP

but also the selected RPs for Product Modelling. Here you can see what RP is

being used for modelling, and can update existing, recommended or any

alternatives. This may be the cause of your modelling RPs and subsequent

templates not aligning to the RP within your client’s Fact Find.

AdviceOS allows a User to set up the risk

profile for the individual client, partner, or any separate entities. However,

we do not set up different RPs for an individual (i.e., super v personal) as we

consider their portfolio from a holistic perspective that includes all assets

that are invested.

AdviceOS allows a User to set up the risk

profile for the individual client, partner, or any separate entities. However,

we do not set up a risk profile at the client group level (joint) within Fact

Find as this is based on the understanding that risk profiles should be

individual to a client rather than a client group.

Should joint assets be within scope of advice,

you can model the advice within our different modules and set a specific asset

allocation for these joint assets. However, there is no joint level risk

profile in Fact Find and it would be at the discretion of the Practice and

their compliance team to hold a conversation with the clients whereby an

agreement takes place and file notes why modelling has assumed a certain RP.The advisory panel located within the client

admin pop-out allows you to add all relevant User’s to your client &

restrict access as required. You can use the +Add button to add

additional User’s and determine their relationship to the client, while ticking

the ‘restrict access to advisory panel users’ will ensure that only those

User’s listed will be able to view this client group. This may be useful for

sensitive clients.

To change

the adviser of a client, select the client and navigate to the Main Menu >

Client > Fact Find > Personal details. Click the Client admin pop-up button

then select the adviser from the drop-down menu and select Change. The adviser

must be an existing AdviceOS user, set up as an Adviser for your practice.

Referral sources, Client tags & multi-tags

are all created within the client admin section, which can be accessed via

Client > Fact Find > Personal details and then the pop-up on the

right-hand side.

Client tags & multi-tags work the same,

however a client can have multiple multi-tags selected while they can only have

one client tag.

The office field allows you to manage

visibility permissions of your clients. You can select some clients to be part

of certain offices and then only give certain User’s access to see these

offices. Note though that all User’s with access to an office will be able to

access all clients within that office. If you would prefer to restrict access

based on a client’s adviser this can be organized with the Midwinter support

team.

Unfortunately,

a Licensee or Practice is unable to create Office’s. This must be done by the

Midwinter team, please contact us via

info@midwinter.com.au and we can assist with this request.

This information cannot be updated in the

Client section. Details are completed within the Advanced Admin > FDS

Management or Advanced Admin > FTA Management modules.

Yes. Review dates can be managed at the

individual or group level. FDS and FTA documents can be managed within the

Advanced Admin module and can be created at the individual or group level.

The FSG or Privacy Policy document needs to be

updated in the Settings > Templates & Field Management > FSG and

Privacy Policy section of AOS. From the Client > Compliance section you

can then provide an FSG, view historical data or review file notes.

This needs to be completed within the Fact

find > Associates page and need to ensure the Third-Party

authorisation field is ticked. You will then be able to see this

information on the Compliance screen.

From the Contact details page of Fact Find you

can tick on the do not contact field. You will then be warned if you try

to send any communication via email or text to this client group, and this

communication will not be sent.

You can add

a residential & postal address to the client’s profile via Fact find

> contact details. If you wish to add a Business Address this can be

done via the additional addresses field at the bottom of the same page.

No, however

a workaround may be to enter it in employment history with no end date and

leave a comment.

No, this

area is designed for record keeping and will have to be manually added into

Cashflow & Capital as required.

No,

this area is designed for record keeping and the client’s eligibility for

Centrelink benefits will depend on the information input within Cashflow &

Capital

To remove

the Medicare Levy Surcharge (MLS) you need to navigate to Fact find >

Personal details and tick on that your client has active private health

insurance. This will correctly adjust the tax calculations for your client.

The Other

tax is calculated as an expense in the summary table and is by design to keep

the Tax calculations from Income sources separate from additional manually

added tax.

In most cases Salary & Super Salary should

be by default the same value, however Super Salary is used to describe the

amount of Salary someone receives that is eligible for employer SG

contributions. Salary is the total amount of income someone receives, that may

include additional funds ineligible for employer SG. Modelling within AdviceOS

uses the Super Salary figure to determine superannuation payments from your

client’s employer.

In the example below there is a Super salary of

$100,000 that has eligible SG of $10,500 and an additional $25,000 income that

is not eligible for SG payments.

If you have created an investment loan in personal

assets and liabilities the mortgage payments will appear in income &

expenses. Principal or capital repayments are not tax deductible, only the

interest component directly related to your property is tax deductible. Any

non-deductible part of the investment loan repayment will appear under ‘other

repayments’.

If your

clients are paying Interest Only on their mortgage, you can update this

information within personal assets and liabilities. Ensure that the

monthly repayment amount is equal to the minimum interest payable.

To add

information of children and/or dependants is within the Fact Find >

Estate planning and health section.

Navigate to

client > client actions > client actions.

To split

the clients and retain both individual client records, select Split from

the drop-down menu.

Select the

new Marital Status then click submit.

Alternatively,

if you want to remove the partner and do not want to retain their records, you

can choose to delete the spouse.

If the

clients have a JOINT service agreement, you need to cancel the OSA first and

then you will be able to split the clients or delete spouse.

Navigate to

the Main Menu > Client > Client Actions > Client Restore.

Under

Actions, you can choose to restore an Individual or Client Group.

Any

Individuals/Client Groups that have been deleted will appear below. Select the

individual/group to restore then click ‘Submit’. A confirmation window will

appear, click Yes to continue and action

For

compliance purposes, users are unable to make changes to file notes or

documents. If you require any changes please email details of your request to

Midwinter Support info@midwinter.com.au